The Dividend Portfolio That Let Me Walk Away From the Rat Race – $41K/Year in 2026

Here’s a behind-the-scenes look at the dividend portfolio that now earns me over $39,000 a year in passive income—income that gives me the freedom to choose when and if I want to work. It’s the foundation of the financial independence I built after 20 years in a traditional 9-to-5 career.

From Climbing the Ladder to Questioning the Script

After two decades in the working world, climbing from engineer to general manager across multiple countries and industries, I had checked every box society handed me: titles, promotions, and pay raises.

But somewhere along the way, I started to wonder:

Was I chasing my own dream or someone else’s version of success?

At age 40, in 2015, I hit pause. The rat race wasn’t leading to freedom. It was leading to burnout. That moment of clarity sparked a journey – one that led me to rethink how money works, what freedom really means, and how I could earn passive income while I sleep.

The Harsh Reality Behind the Corporate Ladder

If you’re working in today’s world, you probably know the feeling:

- Job security is no longer guaranteed. Even top performers get laid off as industries shift. One of my former bosses, who had just delivered record-breaking global revenue, was let go in his mid-50s. I still remember the call. His voice cracked. His eyes welled up on video. He had given everything to the company, only to be dismissed without warning.

- Inflation is creeping up every year, quietly eating away at your purchasing power.

- Office politics are exhausting, and even the most capable professionals can burn out. I’ve been there.

- You’re always sprinting. Higher targets. Tighter deadlines. Constant performance reviews.

And even if you “make it,” you’re still trading time for money and you never really know when your turn is up.

As Warren Buffett famously said:

“If you don’t find a way to make money while you sleep, you will work until you die.”

My Response: Earning Passive Income While I Sleep

In 2015, I began building a dividend income portfolio, focusing on companies that pay consistent, growing dividends. I wasn’t just chasing returns; I was buying back my freedom.

Unlike typical dollar-cost averaging investors, I take a more strategic, value-driven approach:

- I buy more during market dips, when others are fearful.

- I avoid trendy, speculative stocks and focus on businesses with stable earnings, strong balance sheets, and a reliable dividend track record.

- I prioritize income over hype. My goal is consistent cash flow, not just potential appreciation.

This method allowed me to build a portfolio that paid me whether the market was up or down and that income only grew stronger with time.

My Portfolio Today: The Engine Behind My Financial Freedom

As of Jan 2026, my portfolio is projected to generate $39,269 in dividends this year. That’s income that continues whether I’m working, traveling, or sleeping.

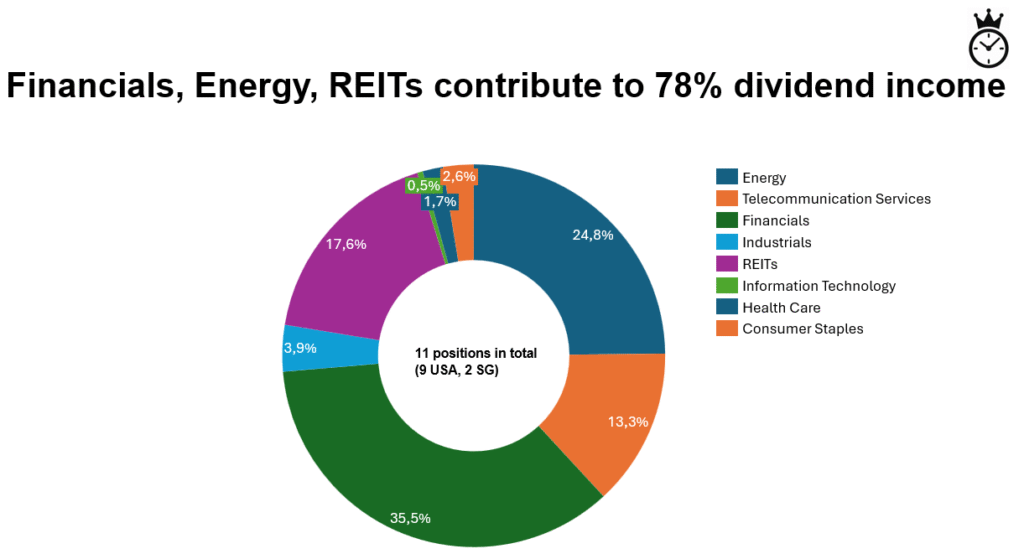

I hold 11 stocks:

9 from the U.S.

2 from Singapore

Sector Allocation (by dividend income):

- Financials – 35.5%

- Energy – 24.8%

- REITs – 17.6%

My approach is focused and intentional. While many financial blogs focus on flashy returns or the latest tech trend, mine is different. I’m a regular Asian 9-to-5 employee, not a finance influencer or full-time investor. My journey is grounded in real responsibilities, real setbacks, and real decisions.

From just $23 in dividends in 2015 to over $41,000 today, this growth wasn’t luck. It came from:

- Saving aggressively

- Investing consistently

- Reinvesting dividends

- Staying invested during downturns

- Ignoring the noise

- Focusing on fundamentals

And above all – being patient

What Financial Freedom Really Means

To me, financial freedom doesn’t mean retiring on a beach (though I’m not ruling that out). It means:

- No longer fearing layoffs

- Not living paycheck to paycheck

- Having the mental space to ask: What really matters now?

I can walk away from the rat race if I choose without the fear of not being able to support my family.

That’s not luck.

That’s a plan, executed with discipline.

How You Can Start Your Own FIRE Journey

You don’t need to be a finance expert. You don’t need to be in the U.S. You don’t even need to be perfect.

Here’s what worked for me and what can work for you:

- Track your spending – Know exactly how much you need to live. You can’t hit a target you don’t define.

- Save aggressively – I saved over 50% of my income during my accumulation years.

- Invest consistently – I dollar-cost averaging on down markets, especially when markets are steeped in fear.

- Focus on income – Look for investments that pay you regularly, not just those that “might go up.”

- Be patient – Time is your greatest ally. Let compounding do its magic.

The Power of Patience

One of the most overlooked forces in investing is time. As Charlie Munger famously said (paraphrased):

“The big money is not in the buying or the selling, but in the waiting.”

- I don’t try to time the market.

- I don’t chase hype.

- I buy high-quality businesses and I wait.

- While others panic, I accumulate.

- While others chase trends, I stay the course.

- My portfolio today is the product of years of patience, not predictions.

Final Words: Freedom Is Built, Not Bought

If you’re just starting out, remember this:

- You don’t need to be perfect.

- You don’t need a finance degree.

- You just need to start and stay the course.

I was a regular engineer, with no financial background. But I learned. I failed. I kept going.

A regular 9-to-5 employee can absolutely achieve FIRE.

You can earn passive income while you sleep.

You can build financial freedom – one smart step at a time.

To my sons, and anyone else reading this:

Don’t trade your time forever. Build something that works for you, even when you’re not working.

Freedom isn’t handed to you. It’s built. Start building now.

What's your Strategy?

Like what you see? Share it!

Discover more from BOSS OF MY TIME (BOMT)

Subscribe to get the latest posts sent to your email.