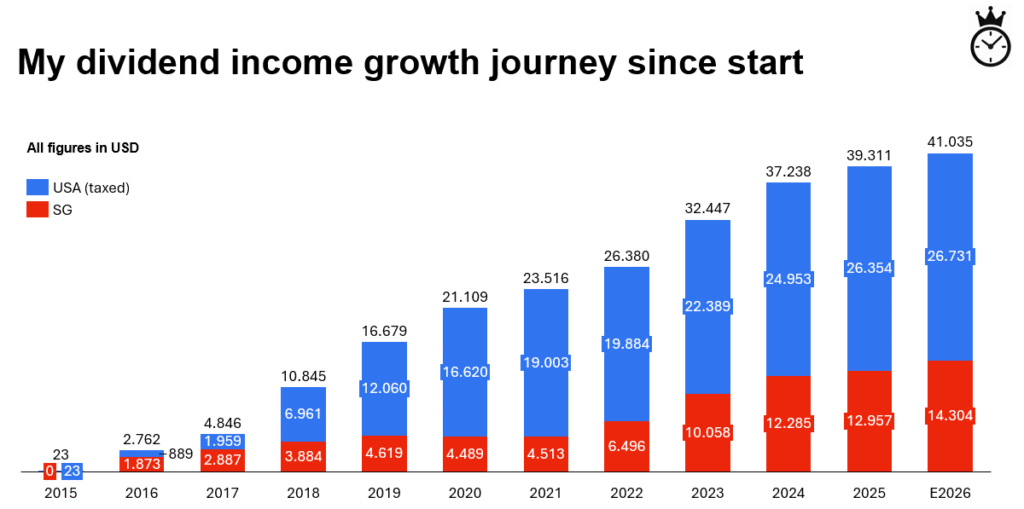

How I Make USD 41,000 a Year While I Sleep That Allows Me To be FIRE!

I used to believe that earning money solely meant trading my time for a paycheck. Like many, I followed the traditional path: good grades, a stable job, and a steady income. However, after two decades of working a 9-to-5, I realized something important: I didn’t want to rely on a job forever. I craved freedom, peace of mind, and income that works even when I’m not working.

Fast forward to today, I now generate USD 41,000 annually in passive income, even while I sleep. That’s over USD 100 a day in earnings. Before you get skeptical or think this happened overnight, let me be clear: this journey took years of disciplined saving, strategic investing, making mistakes, and staying committed.

I’m not a tech founder nor did I strike it rich with crypto or startup stocks. Instead, I’m an average person who used consistent investing in dividend stocks to build income that doesn’t depend on my daily effort.

My Investment Strategy in a Nutshell

My approach revolves around investing in dividend-paying stocks, which regularly distribute part of their earnings back to shareholders – people like me. These dividends form the foundation of my passive income.

My portfolio is divided between two regions:

- 85% in the U.S. stock market – for stability, consistent dividends, and long-term growth

- 15% in the Singapore stock market – mainly for higher yields and currency diversification

This diversified strategy allows me to benefit from the strengths of both markets. The U.S. provides reliable growth and dividends, while Singapore offers attractive yields through REITs and dividend stocks.

Breaking Down the Numbers

Here’s a quick snapshot of how my USD 41,000 annual income is generated. When I started, in 2015, my investment dividend income was only USD 23.

I reinvest dividends received, buying more stocks whenever market panic creates buying opportunities. And yes, this figure is after taxes since I’m investing as a foreigner in U.S. stocks, I pay about 30% withholding tax on dividends.

For example, if a company pays USD 100 in dividends, I receive only USD 70 after tax. This is an important factor for international investors to consider. Despite this, U.S. companies still offer some of the most consistent and strong dividend payouts. And the best part? I don’t need to sell my stocks to generate income; these recurring payouts sustain me.

Why I Chose Dividend Investing

When I started my journey in 2015, I wasn’t sure what the best strategy was. Over time, I realized that I value income and stability more than hype or quick gains. That’s why dividend investing resonated with me, because:

- I receive regular payments (monthly, quarterly, or semi-annually)

- I can reinvest dividends to grow my portfolio faster

- I don’t need to time the market or predict stock prices

- I can live off this income when I decide to stop working

Mistakes I Made Along the Way

Of course, the path wasn’t perfect. I faced setbacks and learned valuable lessons, including:

- Chasing high-yield stocks without checking their fundamentals, leading to dividend cuts

- Not diversifying enough in the early days

However, these mistakes taught me resilience. I continued investing, learning, and adjusting my approach. That persistence is what ultimately led me to where I am today.

Why this Blog Exists

I created this blog not just to share my results but to document the lessons I’ve learned. It’s my personal journal—meant for readers like you and for my kids.

One day, I hope they’ll look back and see what their dad experienced – the wins, the failures, and the mindset shifts—and apply these lessons to live intentionally with financial freedom.

The Freedom It Gives Me

Today, I still work a job, not because I have to, but because I choose to. This passive income gives me options:

- I can walk away from my job anytime, knowing my finances are secure

- I can spend more quality time with my wife and kids

- I can pursue passion projects, like this blog, to share what I’ve learned

Final Thoughts

Earning USD 41,000 per year in passive income didn’t happen by chance or overnight success. It resulted from:

- Consistent saving

- Long-term investing

- A risk-tolerance-aligned strategy

- Learning from mistakes

- Patience during market dips

If you’re dreaming of earning while you sleep, not to get rich quick, but to live freely, I hope my story shows it’s possible. It’s not always easy, but possible.

Stay consistent. Stay curious. And start now, your future self will thank you.

Full details of my dividend paying portfolio with ticker symbol is available on this post: How Betting Big on Dividend Stocks Helped Me Achieve Financial Independence Faster.

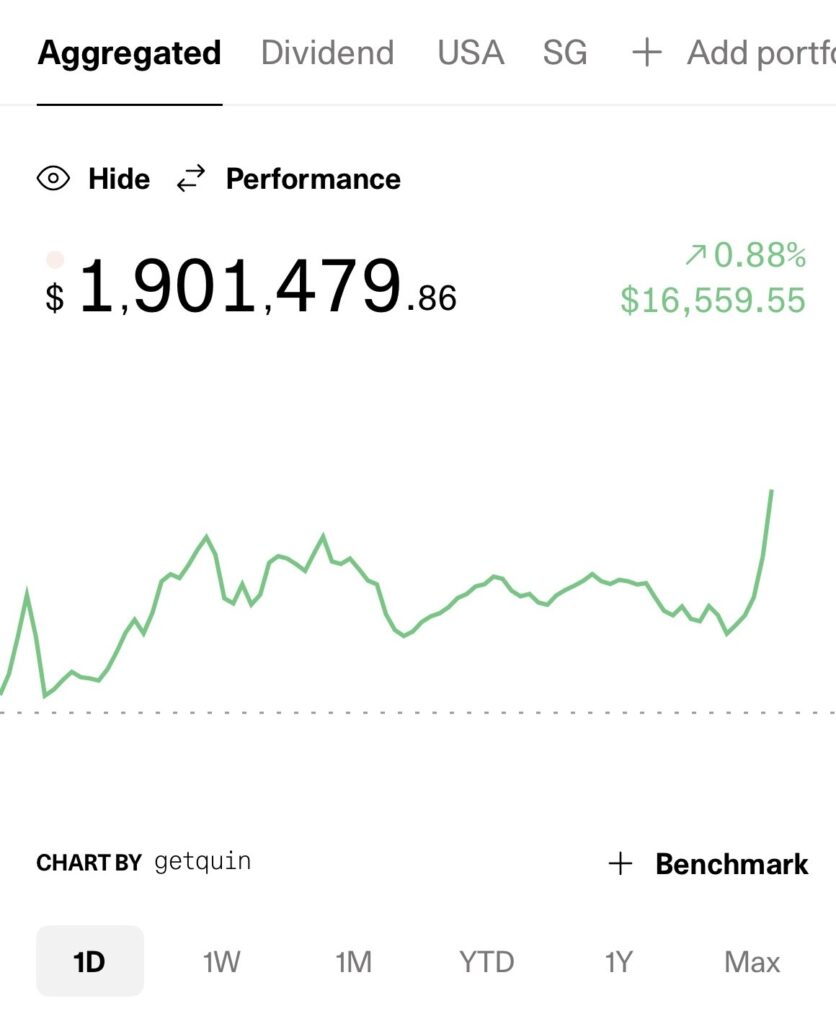

Below is the Jan 15th 2026 snapshot of my portfolio (85% dividend growth and 15% growth):

How much passive income would you need to leave your 9-5?

Like what you see? Share it!

Discover more from BOSS OF MY TIME (BOMT)

Subscribe to get the latest posts sent to your email.

2 thoughts on “How I Make USD 41,000 a year while I sleep that allows me to be FIRE!”

What dividend stocks you chosen or invested currently. Can we get to know please

Some of them that I hold are XOM, WFC, O, T, MMM, … all 11 positions give me USD 39,000 passive income this year while I sleep. Full details is illustrated via my FIRE dividend portfolio.