How Betting Big on Dividend Stocks Helped Me Achieve Financial Independence Faster

“Opportunities come infrequently. When it’s raining gold, reach for a bucket, not a thimble.” — Warren Buffett

This quote by Warren Buffett perfectly captures the mindset shift that accelerated my journey to financial independence.

When I started investing at the end of 2015, I wasn’t dabbling with dozens of stocks hoping for quick wins. I took the opposite route – I bet big on a handful of dividend-paying businesses I believed in. I focused, committed, and stuck with them through market cycles.

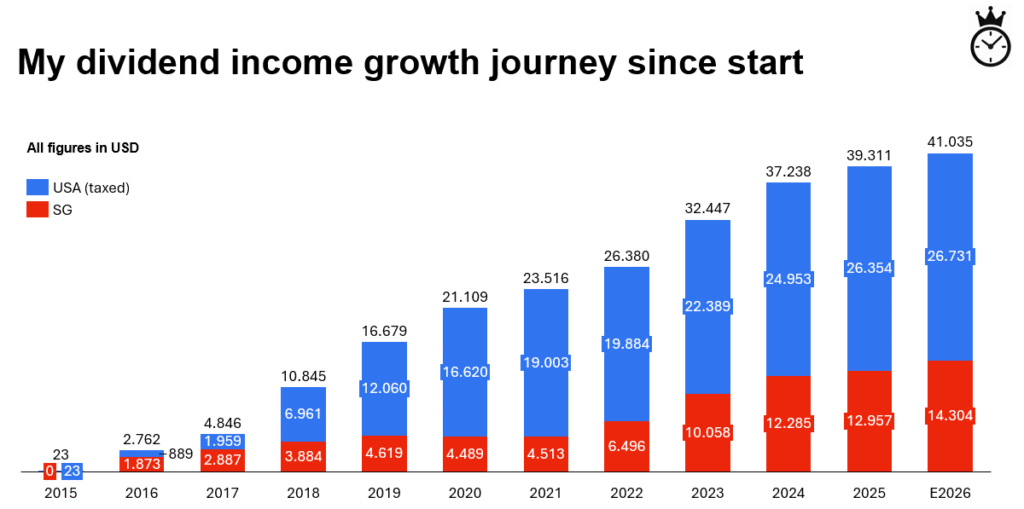

Fast forward to today, my dividend portfolio is on track to generate over USD 41,000 in passive income in 2026. That income now funds my freedom, giving me full control over how I spend my time.

Here’s why betting big worked, what legends like Buffett and Charlie Munger have to say about it, and how my real-life 11-stock dividend portfolio embodies this approach.

The Case for Concentration

Mainstream advice says: diversify widely to stay safe. But great investors know otherwise.

- Warren Buffett: “Diversification is protection against ignorance. It makes little sense if you know what you’re doing.”

- Charlie Munger: “The wise ones bet heavily when the world offers them that opportunity. They bet big when they have the odds. And the rest of the time, they don’t.”

The key isn’t owning more stocks – it’s owning the right ones in meaningful amounts.

Instead of watering down my capital across 30 or 40 small positions, I focused on a core portfolio of 11 dividend stocks, each carefully selected and sized with conviction. That approach helped me escape the rat race – not by chasing, but by concentrating.

Why Betting Big Works (If You Do the Work)

When you bet big on strong, dividend-paying companies:

- Your returns are more significant when the business performs well.

- Your dividend income grows faster and becomes more reliable.

- You spend less time managing noise and more time compounding wealth.

Charlie Munger once said:

“The big money is not in the buying or selling, but in the waiting.”

But waiting requires confidence. And confidence comes from knowing what you own and why.

My 11-Stock Portfolio: Built With Intention

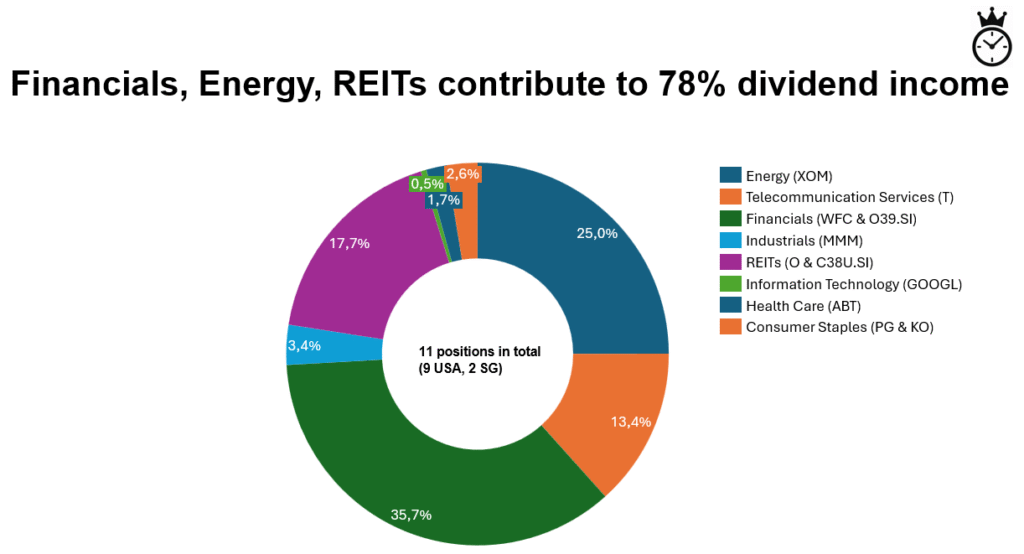

Below charts show my current dividend portfolio as of Jan 15th, 2026. It includes 11 high-conviction positions across sectors that offer stability, cash flow, and long-term relevance.

Let me break it down by sector and why each one made it into my “big bets”:

Energy

- ExxonMobil (XOM): A reliable dividend giant. I bought heavily when oil sentiment was low. Now it delivers more than USD 10K annually in dividends alone.

Telecommunication Services

- AT&T (T): Out of favor for years, but I saw consistent cash flow. Betting big during uncertainty is now paying off.

Financials

- Wells Fargo (WFC): A turnaround story. Bought during a period of fear, stayed for the recovery.

- OCBC (O39.SI): One of Southeast Asia’s strongest banks. Solid fundamentals and consistent dividends.

Industrials

- 3M (MMM): Despite legal risks and declining sentiment, I trust in its long-term industrial moat and decades-long dividend track record.

REITs

- Realty Income (O): The “Monthly Dividend Company.” This is one of my favorite REITs and a solid passive income workhorse.

- CapitaLand Integrated (C38U.SI): My Singapore REIT pick. Strong mall and office assets in Asia’s growth hubs.

Information Technology

- Alphabet (GOOGL): just started to pay dividends in June 2024, but it has tremendous free cash flow and will likely to continue rewarding shareholders. Long-term optionality play.

Health Care

- Abbott Laboratories (ABT): Resilient, consistent, and committed to increasing payouts. An anchor in my health care allocation.

Consumer Staples

- Procter & Gamble (PG): A recession-proof giant with a proven dividend history.

- Coca-Cola (KO): A Buffett favorite, and one of mine too. The brand, the moat, and the dividends are world-class.

2026 Milestone: $41,000 in Passive Income

As the charts show, I’ve concentrated in these 11 stocks, which value is at over USD 1.58 million as of Jan 2026 (my total invested amount is USD 650 k) and I estimate USD 41,000 in dividends this year alone.

That’s not theoretical. That’s real money showing up in my brokerage account while I sleep, travel, or spend time with family.

This portfolio didn’t appear overnight. It was built over nearly a decade, through:

- Consistent investing (even during downturns),

- Dividend reinvestments, and

- A disciplined focus on high-conviction bets.

Lessons for Anyone Wanting to “Bet Big” Smartly

- Start with deep understanding.

Only bet big on companies you truly understand business model, earnings power, debt levels, and dividend safety. - Buy when value appears.

High-conviction investing often means buying what others are avoiding. That’s where the best deals are. - Size your positions with conviction.

If it’s not worth a 5–10% stake, it might not be worth owning at all. - Stay the course.

Time + discipline + cash flow = freedom.

Final Thoughts

The path to financial independence doesn’t require extreme risk. It requires focused conviction, patient capital, and the courage to bet big when the odds are in your favor.

I started my journey in late 2015. And today, nearly a decade later, my dividend portfolio pays me more than USD 41,000 a year. That income now covers my core living expenses and gives me the freedom to choose how I live, work, and give back.

So the next time you come across a golden opportunity, ask yourself:

Is this a thimble moment… or a bucket one?

To your buckets of freedom,

—Boss Of My Time

Like what you see? Share it!

Discover more from BOSS OF MY TIME (BOMT)

Subscribe to get the latest posts sent to your email.